Tax rule question

- mikerotec

- OFFLINE

-

Platinum Member

- Posts: 351

- Thanks: 28

- Karma: 2

6 years 2 months ago #301844

by mikerotec

Tax rule question was created by mikerotec

Tax oddity! I just did a routine "paid subscription test", signed up a new test user (with imaginary address in USA) and subscribed them to one of our paid subscriptions. Paid using a credit card. User was billed taxes! Shouldn't have been, really ( we do not charge tax to US clients) ...

According to the Paypal payment item, "The sender of this payment is not verified and is located outside the US."

Yes, the credit card used was from a bank outside the USA (in a country covered by our tax rules) and I was in the same country doing the test account ( so, Geo-IP would have detected it).

However, the user put in a USA address - shouldn't that address information over-ride which bank card was used, and the physical location of the user when they happened to be making the payment? Based on the location of the user and the credit card, yes the tax was billed correctly. But what if a US client happens to sign up while travelling outside the USA, and for whatever reason uses someone else's credit card for convenience?

Just curious...

According to the Paypal payment item, "The sender of this payment is not verified and is located outside the US."

Yes, the credit card used was from a bank outside the USA (in a country covered by our tax rules) and I was in the same country doing the test account ( so, Geo-IP would have detected it).

However, the user put in a USA address - shouldn't that address information over-ride which bank card was used, and the physical location of the user when they happened to be making the payment? Based on the location of the user and the credit card, yes the tax was billed correctly. But what if a US client happens to sign up while travelling outside the USA, and for whatever reason uses someone else's credit card for convenience?

Just curious...

Please Log in to join the conversation.

krileon

Team Member

Team Member- OFFLINE

- Posts: 68515

- Thanks: 9087

- Karma: 1434

6 years 2 months ago #301864

by krileon

Kyle (Krileon)

Community Builder Team Member

Before posting on forums: Read FAQ thoroughly + Read our Documentation + Search the forums

CB links: Documentation - Localization - CB Quickstart - CB Paid Subscriptions - Add-Ons - Forge

--

If you are a Professional, Developer, or CB Paid Subscriptions subscriber and have a support issue please always post in your respective support forums for best results!

--

If I've missed your support post with a delay of 3 days or greater and are a Professional, Developer, or CBSubs subscriber please send me a private message with your thread and will reply when possible!

--

Please note I am available Monday - Friday from 8:00 AM CST to 4:00 PM CST. I am away on weekends (Saturday and Sunday) and if I've missed your post on or before a weekend after business hours please wait for the next following business day (Monday) and will get to your issue as soon as possible, thank you.

--

My role here is to provide guidance and assistance. I cannot provide custom code for each custom requirement. Please do not inquire me about custom development.

Replied by krileon on topic Tax rule question

Are you sure CBSubs taxed them? Did you see the tax line in the basket before selecting a payment method? Sounds like the tax/fee came from PayPal it self, which CBSubs has no control over and is based off the card location I believe.

No.shouldn't that address information over-ride which bank card was used

Kyle (Krileon)

Community Builder Team Member

Before posting on forums: Read FAQ thoroughly + Read our Documentation + Search the forums

CB links: Documentation - Localization - CB Quickstart - CB Paid Subscriptions - Add-Ons - Forge

--

If you are a Professional, Developer, or CB Paid Subscriptions subscriber and have a support issue please always post in your respective support forums for best results!

--

If I've missed your support post with a delay of 3 days or greater and are a Professional, Developer, or CBSubs subscriber please send me a private message with your thread and will reply when possible!

--

Please note I am available Monday - Friday from 8:00 AM CST to 4:00 PM CST. I am away on weekends (Saturday and Sunday) and if I've missed your post on or before a weekend after business hours please wait for the next following business day (Monday) and will get to your issue as soon as possible, thank you.

--

My role here is to provide guidance and assistance. I cannot provide custom code for each custom requirement. Please do not inquire me about custom development.

The following user(s) said Thank You: mikerotec

Please Log in to join the conversation.

- mikerotec

- OFFLINE

-

Platinum Member

- Posts: 351

- Thanks: 28

- Karma: 2

6 years 2 months ago #301867

by mikerotec

Replied by mikerotec on topic Tax rule question

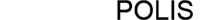

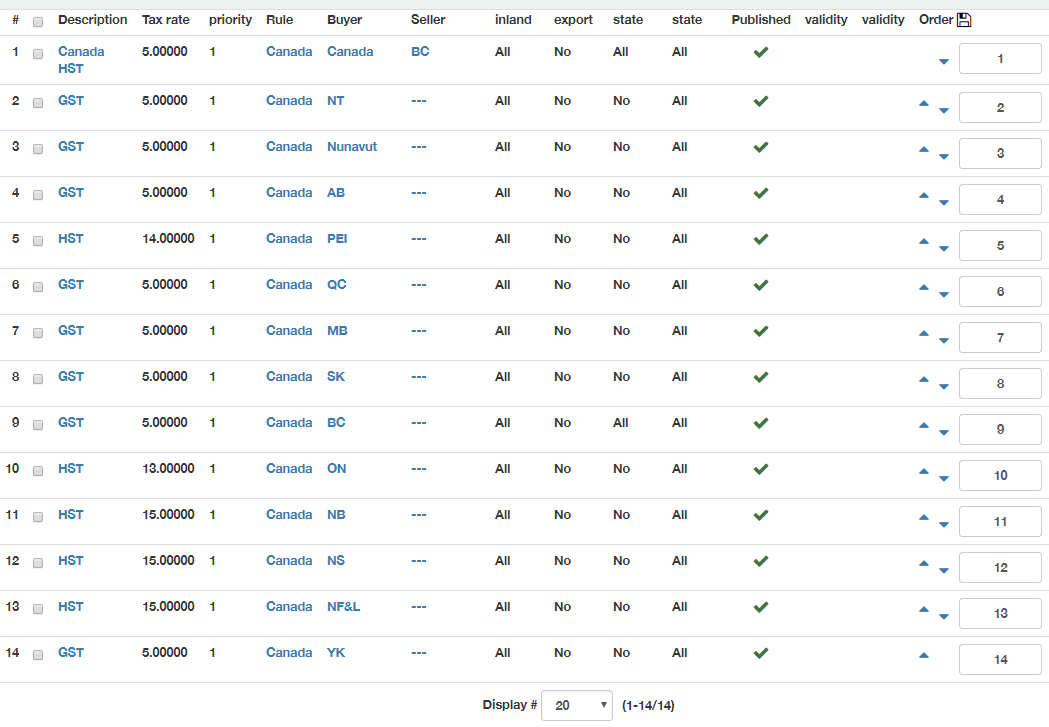

The tax line is in the payment basket.

Please Log in to join the conversation.

krileon

Team Member

Team Member- OFFLINE

- Posts: 68515

- Thanks: 9087

- Karma: 1434

6 years 2 months ago - 6 years 2 months ago #301902

by krileon

Kyle (Krileon)

Community Builder Team Member

Before posting on forums: Read FAQ thoroughly + Read our Documentation + Search the forums

CB links: Documentation - Localization - CB Quickstart - CB Paid Subscriptions - Add-Ons - Forge

--

If you are a Professional, Developer, or CB Paid Subscriptions subscriber and have a support issue please always post in your respective support forums for best results!

--

If I've missed your support post with a delay of 3 days or greater and are a Professional, Developer, or CBSubs subscriber please send me a private message with your thread and will reply when possible!

--

Please note I am available Monday - Friday from 8:00 AM CST to 4:00 PM CST. I am away on weekends (Saturday and Sunday) and if I've missed your post on or before a weekend after business hours please wait for the next following business day (Monday) and will get to your issue as soon as possible, thank you.

--

My role here is to provide guidance and assistance. I cannot provide custom code for each custom requirement. Please do not inquire me about custom development.

Replied by krileon on topic Tax rule question

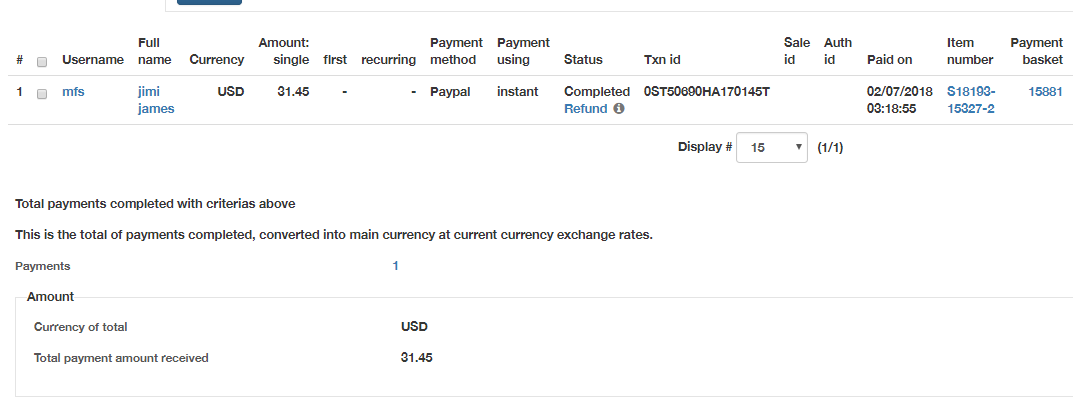

Ok, then it's coming from CBSubs. CBSubs uses the invoice address to determine if tax should apply. Within your Tax Rate in CBSubs > Tax you should just need to adjust "Geographic Zone of Buyer". If you don't see the geographic zone you want it to apply to then within Geographic Zones in CBSubs > Tax be sure to add the geographic zone you're needing. Be sure to cancel the basket between tests.

Kyle (Krileon)

Community Builder Team Member

Before posting on forums: Read FAQ thoroughly + Read our Documentation + Search the forums

CB links: Documentation - Localization - CB Quickstart - CB Paid Subscriptions - Add-Ons - Forge

--

If you are a Professional, Developer, or CB Paid Subscriptions subscriber and have a support issue please always post in your respective support forums for best results!

--

If I've missed your support post with a delay of 3 days or greater and are a Professional, Developer, or CBSubs subscriber please send me a private message with your thread and will reply when possible!

--

Please note I am available Monday - Friday from 8:00 AM CST to 4:00 PM CST. I am away on weekends (Saturday and Sunday) and if I've missed your post on or before a weekend after business hours please wait for the next following business day (Monday) and will get to your issue as soon as possible, thank you.

--

My role here is to provide guidance and assistance. I cannot provide custom code for each custom requirement. Please do not inquire me about custom development.

Last edit: 6 years 2 months ago by krileon.

Please Log in to join the conversation.

- mikerotec

- OFFLINE

-

Platinum Member

- Posts: 351

- Thanks: 28

- Karma: 2

6 years 2 months ago #301909

by mikerotec

Replied by mikerotec on topic Tax rule question

All of our tax rates are already set up with correct geographical zones. This user supplied a country outside of those zones.

I don't recall seeing this ever before, (or since!) - users from that country (or any country outside our own) never pay tax.

I don't recall seeing this ever before, (or since!) - users from that country (or any country outside our own) never pay tax.

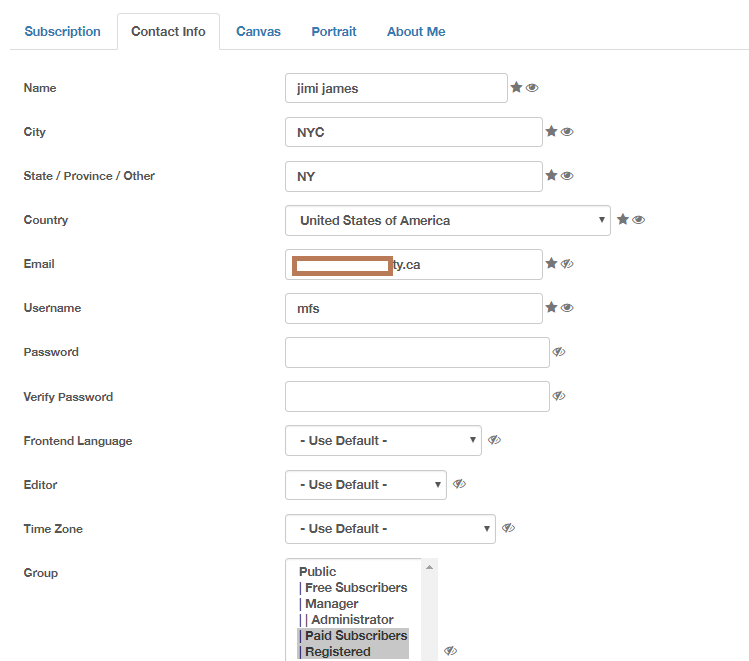

This message contains confidential information

Please Log in to join the conversation.

krileon

Team Member

Team Member- OFFLINE

- Posts: 68515

- Thanks: 9087

- Karma: 1434

6 years 2 months ago #301974

by krileon

Kyle (Krileon)

Community Builder Team Member

Before posting on forums: Read FAQ thoroughly + Read our Documentation + Search the forums

CB links: Documentation - Localization - CB Quickstart - CB Paid Subscriptions - Add-Ons - Forge

--

If you are a Professional, Developer, or CB Paid Subscriptions subscriber and have a support issue please always post in your respective support forums for best results!

--

If I've missed your support post with a delay of 3 days or greater and are a Professional, Developer, or CBSubs subscriber please send me a private message with your thread and will reply when possible!

--

Please note I am available Monday - Friday from 8:00 AM CST to 4:00 PM CST. I am away on weekends (Saturday and Sunday) and if I've missed your post on or before a weekend after business hours please wait for the next following business day (Monday) and will get to your issue as soon as possible, thank you.

--

My role here is to provide guidance and assistance. I cannot provide custom code for each custom requirement. Please do not inquire me about custom development.

Replied by krileon on topic Tax rule question

Looks like it applied your first tax rule to them and is the only one with a seller geographic location specified and maybe why the tax rule was applied since you are the seller. Only other reason I can think of is "Default Customer Country", "Default Customer State / Province", and/or "Default Buyer Zip Code" were specified within CBSubs > Settings > Tax that maybe causing it.

Kyle (Krileon)

Community Builder Team Member

Before posting on forums: Read FAQ thoroughly + Read our Documentation + Search the forums

CB links: Documentation - Localization - CB Quickstart - CB Paid Subscriptions - Add-Ons - Forge

--

If you are a Professional, Developer, or CB Paid Subscriptions subscriber and have a support issue please always post in your respective support forums for best results!

--

If I've missed your support post with a delay of 3 days or greater and are a Professional, Developer, or CBSubs subscriber please send me a private message with your thread and will reply when possible!

--

Please note I am available Monday - Friday from 8:00 AM CST to 4:00 PM CST. I am away on weekends (Saturday and Sunday) and if I've missed your post on or before a weekend after business hours please wait for the next following business day (Monday) and will get to your issue as soon as possible, thank you.

--

My role here is to provide guidance and assistance. I cannot provide custom code for each custom requirement. Please do not inquire me about custom development.

Please Log in to join the conversation.

Moderators: beat, nant, krileon

Time to create page: 0.227 seconds

-

You are here:

- Home

- Forums

- Support and Presales

- CB Paid Subscriptions Support

- Tax rule question