Issue with EU VAT taxes

- liaskas

- OFFLINE

-

Platinum Member

- Posts: 385

- Thanks: 37

- Karma: 2

Add-ons

Add-ons

4 years 4 months ago #315498

by liaskas

Issue with EU VAT taxes was created by liaskas

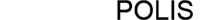

Situation:

Have set all different VAT for all European countries.

Have set that the VAT id must be validated.

When a user purchases, if he provides a VAT id that is correct and registered in VIES then everything works fine.

If a user provides a VAT id that is not correct or not registered in VIES then the TAXES of all EU countries are added to his invoice.

* VIES = VAT Information Exchange System

Please see screenshot...

I do not know if there is something wrong with my setting.

Can you please advise?

Have set all different VAT for all European countries.

Have set that the VAT id must be validated.

When a user purchases, if he provides a VAT id that is correct and registered in VIES then everything works fine.

If a user provides a VAT id that is not correct or not registered in VIES then the TAXES of all EU countries are added to his invoice.

* VIES = VAT Information Exchange System

Please see screenshot...

I do not know if there is something wrong with my setting.

Can you please advise?

Please Log in to join the conversation.

- liaskas

- OFFLINE

-

Platinum Member

- Posts: 385

- Thanks: 37

- Karma: 2

4 years 4 months ago #315535

by liaskas

Replied by liaskas on topic Issue with EU VAT taxes

Any ideas about this issue?

Please Log in to join the conversation.

beat

Team Member

Team Member- OFFLINE

- Posts: 8175

- Thanks: 528

- Karma: 352

4 years 4 months ago #315536

by beat

Beat - Community Builder Team Member

Before posting on forums: Read FAQ thoroughly -- Help us spend more time coding by helping others in this forum, many thanks

CB links: Our membership - CBSubs - Templates - Hosting - Forge - Send me a Private Message (PM) only for private/confidential info

Replied by beat on topic Issue with EU VAT taxes

Hi liaskas,

I am still trying to reproduce your issue. Could not reproduce to have more than a single VAT!

Do you have a screen-dump of the VAT Rate settings for a country ?

Did you choose European Union + Country in the corresponding VAT Rate settings ?

I am still trying to reproduce your issue. Could not reproduce to have more than a single VAT!

Do you have a screen-dump of the VAT Rate settings for a country ?

Did you choose European Union + Country in the corresponding VAT Rate settings ?

Beat - Community Builder Team Member

Before posting on forums: Read FAQ thoroughly -- Help us spend more time coding by helping others in this forum, many thanks

CB links: Our membership - CBSubs - Templates - Hosting - Forge - Send me a Private Message (PM) only for private/confidential info

Please Log in to join the conversation.

- liaskas

- OFFLINE

-

Platinum Member

- Posts: 385

- Thanks: 37

- Karma: 2

4 years 4 months ago #315538

by liaskas

Replied by liaskas on topic Issue with EU VAT taxes

Not sure what you are asking by saying screen-dump

Here is how my settings are:

Tax rules

1. Not subject to sales tax

2. European Countries

Tax rates

28 tax rates like the following...

VAT Bulgaria 20.00000 1 European Countries EU Countries EU Countries All No All All --- 10001

Geographic Zones

EU Countries

Countries Ouside of EU

I do not know if this helps

Here is how my settings are:

Tax rules

1. Not subject to sales tax

2. European Countries

Tax rates

28 tax rates like the following...

VAT Bulgaria 20.00000 1 European Countries EU Countries EU Countries All No All All --- 10001

Geographic Zones

EU Countries

Countries Ouside of EU

I do not know if this helps

Please Log in to join the conversation.

beat

Team Member

Team Member- OFFLINE

- Posts: 8175

- Thanks: 528

- Karma: 352

4 years 4 months ago #315540

by beat

Yes, it helps, IF I understood properly the shorthanded settings.

You need to define a Geographic Zone for each country, and then in your Tax Rates, you need to specify the country, e.g. "Bulgaria", not only in the description, but also in Geographic Zone of Buyer in each Tax Rate setting.

And in each VAT rate setting, you need to have "Does this tax apply for sales outside of the seller Country" set to B2C, then below have "Methods to validate that the customer is a business (B2) for this tax" set to online with EU VAT server (and fill-up your VAT number used for that country for identifying purposes at VIES, otherwise the query won't work).

Beat - Community Builder Team Member

Before posting on forums: Read FAQ thoroughly -- Help us spend more time coding by helping others in this forum, many thanks

CB links: Our membership - CBSubs - Templates - Hosting - Forge - Send me a Private Message (PM) only for private/confidential info

Replied by beat on topic Issue with EU VAT taxes

liaskas wrote: Not sure what you are asking by saying screen-dump

Here is how my settings are:

Tax rules

1. Not subject to sales tax

2. European Countries

Tax rates

28 tax rates like the following...

VAT Bulgaria 20.00000 1 European Countries EU Countries EU Countries All No All All --- 10001

Geographic Zones

EU Countries

Countries Ouside of EU

I do not know if this helps

Yes, it helps, IF I understood properly the shorthanded settings.

You need to define a Geographic Zone for each country, and then in your Tax Rates, you need to specify the country, e.g. "Bulgaria", not only in the description, but also in Geographic Zone of Buyer in each Tax Rate setting.

And in each VAT rate setting, you need to have "Does this tax apply for sales outside of the seller Country" set to B2C, then below have "Methods to validate that the customer is a business (B2) for this tax" set to online with EU VAT server (and fill-up your VAT number used for that country for identifying purposes at VIES, otherwise the query won't work).

Beat - Community Builder Team Member

Before posting on forums: Read FAQ thoroughly -- Help us spend more time coding by helping others in this forum, many thanks

CB links: Our membership - CBSubs - Templates - Hosting - Forge - Send me a Private Message (PM) only for private/confidential info

Please Log in to join the conversation.

- liaskas

- OFFLINE

-

Platinum Member

- Posts: 385

- Thanks: 37

- Karma: 2

4 years 4 months ago #315541

by liaskas

Replied by liaskas on topic Issue with EU VAT taxes

Allow me to do it step by step so that we avoid misconfiguration

So... first thing is to create a Geographic Zone for each one of the EU countries. Right?

So... first thing is to create a Geographic Zone for each one of the EU countries. Right?

Please Log in to join the conversation.

Moderators: beat, nant, krileon

Time to create page: 0.257 seconds

-

You are here:

- Home

- Forums

- Support and Presales

- CB Paid Subscriptions Support

- Issue with EU VAT taxes