EU VAT Law 2015 - Please help - How to do ?

- cavo789

- OFFLINE

-

Junior Member

- Posts: 30

- Thanks: 0

- Karma: 0

Can you please help on setting up a website (CBSubs 4) to be able to apply the tax rate of the buyer for EU regio ?

I can't see where and how to dynamically apply the correct tax based on the country of the buyer.

Second question : how CBSubs will know the buyer's country ? Based on an identification with Paypal (where the country is mentionned and confirmed by Paypal), by asking the buyer (how to make sure he'll no lie), ...

Thanks a lot and yes, we're already the 28 of december

Developper of aeSecure, optimizing and securing your web Apache sites

Please Log in to join the conversation.

- cavo789

- OFFLINE

-

Junior Member

- Posts: 30

- Thanks: 0

- Karma: 0

Here too, I've already spent hours on it, I've read the documentation (CBSubs 3) a lot of times, and no, I'm really not familiar with this matter.

The only thing that I can see when selecting the plan (on the frontend) is the price of the plan. I never see a "Tax amount of ..." and the total price, vat included.

My question : how to make tax working ? Do you've a step by step guide ? How to configure CBSubs for the new EU VAT law (tax percentage depending of the customer's country).

Thanks.

Developper of aeSecure, optimizing and securing your web Apache sites

Please Log in to join the conversation.

nant

Team Member

Team Member- OFFLINE

- Posts: 25531

- Thanks: 1834

- Karma: 877

cavo789 wrote: Please, my request above is still hot : I don't find how to make the tax working.

Here too, I've already spent hours on it, I've read the documentation (CBSubs 3) a lot of times, and no, I'm really not familiar with this matter.

The only thing that I can see when selecting the plan (on the frontend) is the price of the plan. I never see a "Tax amount of ..." and the total price, vat included.

My question : how to make tax working ? Do you've a step by step guide ? How to configure CBSubs for the new EU VAT law (tax percentage depending of the customer's country).

Thanks.

For starters, if you are not selling just e-products, then you do not have to worry about this law (at least not for this year).

Tax setup is described in the documentation - have you followed those instructions?

The tax should show up depending on your configuration when a company fills in the company name and then its VAT number.

--

Nick (nant)

Community Builder Team Member

Before posting on forums: Read FAQ thoroughly + Read our Tutorials + Search the forums

For more add-ons and support: Upgrade your membership

Links: Community Builder - Languages - Adv/Pro/Dev membership - CBSubs Paid Subscriptions - GPL Templates - Hosting

Visit my CB Profile - Send me a Private Message (PM)

Please Log in to join the conversation.

- cavo789

- OFFLINE

-

Junior Member

- Posts: 30

- Thanks: 0

- Karma: 0

Yes, I've read the CBSubs 3 documentation, tax, a lot of time. But sorry to tell this : it's really difficult to understand how it works; even when reading. The documentation try to explain each field, one after one but don't give a global picture.

My error : think that everything is displayed immediatly on the "display plan" frontend screen but no, you need to select the plan first and the coupon code (f.i.) only appears in the second screen, not the first. Same for tax; you need to select your country first... My error to have think that it's immediatly displayed.

Concerning my VAT problem : I'm one step further but ...

Here too, my error (or resulting by a bad configuration) : when displaying the plan (allevents.avonture.be/fr/component/comprofiler/pluginclass.html?user=467&plugin=cbpaidsubscriptions), I see the gross price (70€, price of my product) but no VAT area at all. If I click on the Paypal button at the bottom of the screen, the Paypal form is displayed with the gross price (70€); still no VAT anywhere ==> if the customer continue the payment, the product will be sold like that. Not good !

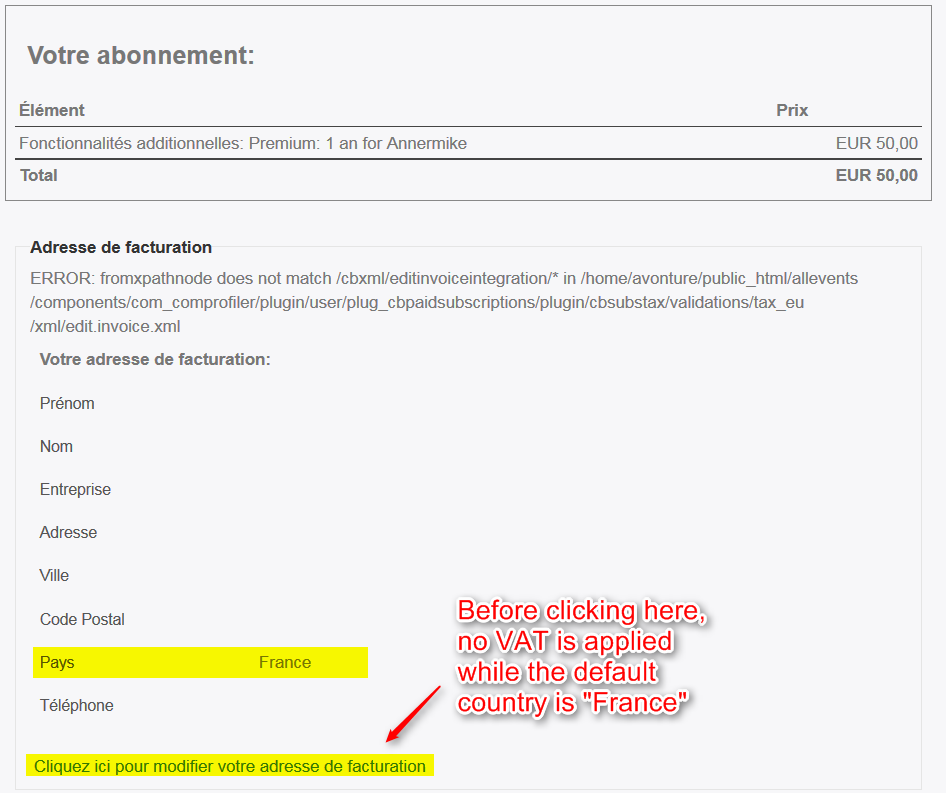

If I go back and don't click on the paypal button (my first screen capture attached to this message), I can see that the default country is France and no VAT applied...

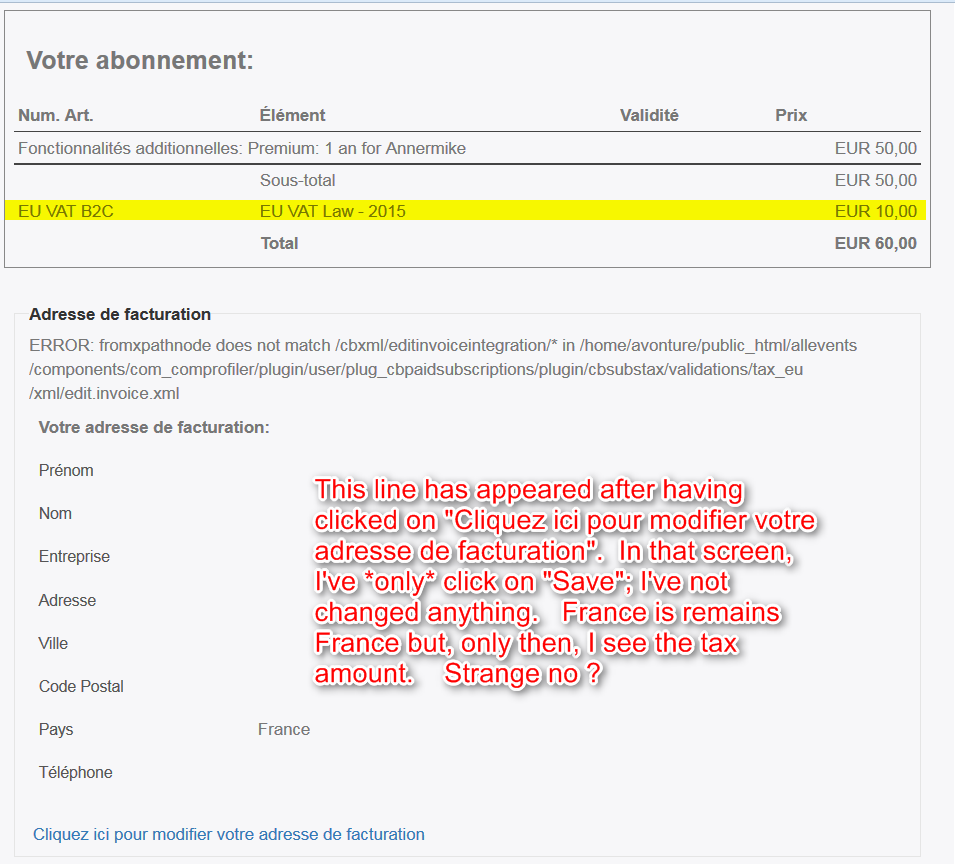

If I click on "Cliquez ici pour modifier votre adresse de facturation", I receive a new screen but there I do nothing; nothing else that click on Save. So I just confirm the country but, now, the VAT is included (screen 2).

Is this normal ?

Why the buyer can buy immediatly without confirmation of his country (=> without tax) ?

Why the tax isn't immediatly applied if a default country is set ?

I should admit that I am not familiar with this matter so it's sure that I miss something...

My need : I'm selling a software and I need to apply the VAT for EU buyers, with their own rate (but you know that story better than I I think). I really don't know how do that ? Does I need to create one Tax rate by country (one for France, one for Italy, ...) in order to be able to specify the correct rate ? How to maintain that rate ? and so on... I hope that CBSubs will "do the magic" for me.

Thank you by advance.

Developper of aeSecure, optimizing and securing your web Apache sites

Please Log in to join the conversation.

nant

Team Member

Team Member- OFFLINE

- Posts: 25531

- Thanks: 1834

- Karma: 877

--

Nick (nant)

Community Builder Team Member

Before posting on forums: Read FAQ thoroughly + Read our Tutorials + Search the forums

For more add-ons and support: Upgrade your membership

Links: Community Builder - Languages - Adv/Pro/Dev membership - CBSubs Paid Subscriptions - GPL Templates - Hosting

Visit my CB Profile - Send me a Private Message (PM)

Please Log in to join the conversation.

- cavo789

- OFFLINE

-

Junior Member

- Posts: 30

- Thanks: 0

- Karma: 0

Developper of aeSecure, optimizing and securing your web Apache sites

Please Log in to join the conversation.

-

You are here:

- Home

- Forums

- Archive

- CBSubs Support

- EU VAT Law 2015 - Please help - How to do ?