EU VAT Law 2015 - Please help - How to do ?

nant

Team Member

Team Member- OFFLINE

- Posts: 25531

- Thanks: 1834

- Karma: 877

--

Nick (nant)

Community Builder Team Member

Before posting on forums: Read FAQ thoroughly + Read our Tutorials + Search the forums

For more add-ons and support: Upgrade your membership

Links: Community Builder - Languages - Adv/Pro/Dev membership - CBSubs Paid Subscriptions - GPL Templates - Hosting

Visit my CB Profile - Send me a Private Message (PM)

Please Log in to join the conversation.

- cavo789

- OFFLINE

-

Junior Member

- Posts: 30

- Thanks: 0

- Karma: 0

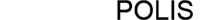

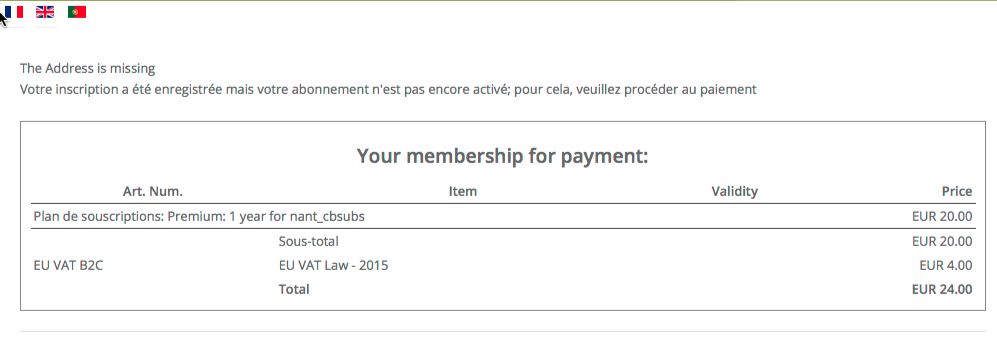

You'll then see the price of the plan, the discount or not (depending on the plan) and ... no tax. There, you'll be able to click on the Paypal button and Paypal's screen don't display tax too.

Cancel and go back to my site. Click on the "Click here to modify your billing adress". Don't modify anything (i.e. let "France" as country), save. The tax is now mentionned. Is it a normal behavior ?

And, always, same question : how should CBSubs works for the different EU country ? How to specify that the rate (actually filled in as 20.0000) should be depend on the customer country.

Thanks Nant

Developper of aeSecure, optimizing and securing your web Apache sites

Please Log in to join the conversation.

nant

Team Member

Team Member- OFFLINE

- Posts: 25531

- Thanks: 1834

- Karma: 877

--

Nick (nant)

Community Builder Team Member

Before posting on forums: Read FAQ thoroughly + Read our Tutorials + Search the forums

For more add-ons and support: Upgrade your membership

Links: Community Builder - Languages - Adv/Pro/Dev membership - CBSubs Paid Subscriptions - GPL Templates - Hosting

Visit my CB Profile - Send me a Private Message (PM)

Please Log in to join the conversation.

- cavo789

- OFFLINE

-

Junior Member

- Posts: 30

- Thanks: 0

- Karma: 0

I've explain here above that when creating a new account on the frontend, the price was mentionned without VAT except if we click on "Modify billing address" and nowhere I've mentionned a company name on that second screen. Just click on Save and the VAT is now there. And I confirm that no company name is filled in (see screen capture below).

You say "You need" : I or my customer ? If I => where. If the customer => what about person who'll buy the product for their own usage; I need to apply the VAT to them (B2C) while shouldn't for businesses (B2B).

And how having dynamic rates ?

Really sorry Nant if my questions seems to be low level.

Developper of aeSecure, optimizing and securing your web Apache sites

Please Log in to join the conversation.

nant

Team Member

Team Member- OFFLINE

- Posts: 25531

- Thanks: 1834

- Karma: 877

cavo789 wrote: Sorry, really sorry, I'm lost...

I've explain here above that when creating a new account on the frontend, the price was mentionned without VAT except if we click on "Modify billing address" and nowhere I've mentionned a company name on that second screen. Just click on Save and the VAT is now there. And I confirm that no company name is filled in (see screen capture below).

You say "You need" : I or my customer ? If I => where. If the customer => what about person who'll buy the product for their own usage; I need to apply the VAT to them (B2C) while shouldn't for businesses (B2B).

And how having dynamic rates ?

Really sorry Nant if my questions seems to be low level.

In your Tax rate there are following settings:

Validation for business (B2B) conditions

Here you can choose the conditions for automated testing of business status of the buyer.

Methods to validate that the customer is a business (B2) for this tax

You have set this to: Company Name and VAT Number filled-in in invoice address

Right?

--

Nick (nant)

Community Builder Team Member

Before posting on forums: Read FAQ thoroughly + Read our Tutorials + Search the forums

For more add-ons and support: Upgrade your membership

Links: Community Builder - Languages - Adv/Pro/Dev membership - CBSubs Paid Subscriptions - GPL Templates - Hosting

Visit my CB Profile - Send me a Private Message (PM)

Please Log in to join the conversation.

- cavo789

- OFFLINE

-

Junior Member

- Posts: 30

- Thanks: 0

- Karma: 0

I'm just trying Nant, just trying...

Except if I am wrong, there is no documentation "CBSubs 4" available (not found) and this part of the screen is not documentated in the CBSubs 3 pdf.

Please don't tell me what I done wrong but what I should do right :-D

My question, still the same, how make things working in order to be able to correctly calculate tax rates for the EU based on the buyer's country. This, dynamically.

For the moment, I've only create a rule with 20% (hardcoded) as rate (France) but this rate isn't correct for all countries and what if a country modify his rate => how make things dynamic ? One "dynamic" tax rule.

Thanks a lot.

Developper of aeSecure, optimizing and securing your web Apache sites

Please Log in to join the conversation.

-

You are here:

- Home

- Forums

- Archive

- CBSubs Support

- EU VAT Law 2015 - Please help - How to do ?